Otto Car Insurance stands as a beacon of innovation and reliability in the realm of automotive protection, inviting you on a journey to discover its unparalleled offerings and exceptional customer-centric approach. With a rich history, unwavering commitment to excellence, and a deep understanding of the industry, Otto Car Insurance sets the stage for an exploration that will leave you empowered and confident behind the wheel.

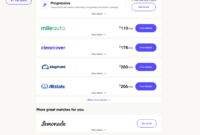

Otto car insurance is a reliable choice for your vehicle protection needs. If you’re considering your options, it’s helpful to explore the list of car insurance companies available. By comparing different providers, you can find the best coverage and rates that suit your specific requirements.

Otto car insurance offers competitive plans with various benefits, ensuring that you have peace of mind while driving.

As we delve into the intricacies of Otto Car Insurance, we will uncover the diverse coverage options available, empowering you to tailor a policy that aligns seamlessly with your unique needs.

From liability and collision coverage to comprehensive and uninsured motorist protection, Otto provides a comprehensive safety net for your vehicle and financial well-being.

Otto car insurance offers a range of coverage options to protect your vehicle. For those seeking a more streamlined and cost-effective approach, direct car insurance can be a suitable choice.

Direct insurers eliminate the middleman, allowing you to purchase coverage directly from the provider.

This often results in lower premiums and a more personalized experience. By considering direct car insurance, you can explore options that align with your specific needs and budget, ensuring that your Otto vehicle remains adequately protected.

Company Overview: Otto Car Insurance

Otto Car Insurance is a leading provider of car insurance in the United States. The company was founded in 1999 and is headquartered in San Francisco, California. Otto’s mission is to provide affordable and reliable car insurance to all drivers, regardless of their driving history or credit score.

Otto’s values include integrity, customer service, and innovation. The company is committed to providing its customers with the best possible experience, and it is constantly looking for ways to improve its products and services.

Otto’s target audience is drivers of all ages and experience levels. The company offers a variety of coverage options to meet the needs of every driver, and it has a team of experienced agents who can help customers find the right policy for their needs.

Market Positioning

Otto Car Insurance is positioned as a value-oriented provider of car insurance. The company offers affordable rates and a variety of discounts, and it has a strong commitment to customer service.

Otto is also a leader in innovation, and it is constantly looking for ways to improve its products and services.

Otto car insurance offers competitive rates and comprehensive coverage, ensuring your vehicle is protected in case of an accident. If you’re looking for even more affordable options, consider exploring low car insurance providers.

These companies specialize in offering budget-friendly policies that meet your specific needs.

By comparing quotes from Otto and low-cost insurers, you can find the perfect balance between coverage and affordability.

Coverage Options

Otto Car Insurance offers a variety of coverage options to meet the needs of every driver. These options include:

- Liability coverage: This coverage protects you from financial liability if you cause an accident that results in bodily injury or property damage to others.

- Collision coverage: This coverage pays for damage to your car if you are involved in an accident with another vehicle.

- Comprehensive coverage: This coverage pays for damage to your car from events other than collisions, such as theft, vandalism, or fire.

- Uninsured/underinsured motorist coverage: This coverage protects you from financial liability if you are involved in an accident with a driver who does not have insurance or who does not have enough insurance to cover your damages.

- Medical payments coverage: This coverage pays for medical expenses for you and your passengers if you are injured in an accident, regardless of who is at fault.

Benefits and Limitations of Each Type of Coverage, Otto car insurance

The benefits and limitations of each type of coverage vary depending on the specific policy. However, in general, liability coverage is the most important type of coverage to have, as it protects you from financial liability if you cause an accident.

Collision coverage and comprehensive coverage are also important, as they can help you pay for repairs to your car if it is damaged in an accident or by another event.

Uninsured/underinsured motorist coverage and medical payments coverage are optional, but they can provide valuable protection in the event of an accident.

Uninsured/underinsured motorist coverage can protect you from financial liability if you are involved in an accident with a driver who does not have insurance or who does not have enough insurance to cover your damages.

Medical payments coverage can help you pay for medical expenses for you and your passengers if you are injured in an accident, regardless of who is at fault.

Examples of Scenarios Where Each Type of Coverage Would Be Applicable

Here are some examples of scenarios where each type of coverage would be applicable:

- Liability coverage: If you cause an accident that results in bodily injury or property damage to others, liability coverage will pay for the damages.

- Collision coverage: If you are involved in an accident with another vehicle and your car is damaged, collision coverage will pay for the repairs.

- Comprehensive coverage: If your car is stolen, vandalized, or damaged by fire, comprehensive coverage will pay for the repairs.

- Uninsured/underinsured motorist coverage: If you are involved in an accident with a driver who does not have insurance or who does not have enough insurance to cover your damages, uninsured/underinsured motorist coverage will pay for your damages.

- Medical payments coverage: If you are injured in an accident, regardless of who is at fault, medical payments coverage will help you pay for your medical expenses.

Pricing and Discounts

Otto Car Insurance determines insurance premiums based on a variety of factors, including your driving history, age, location, and the type of car you drive. The company also offers a variety of discounts, including:

- Good driver discount: This discount is available to drivers who have a clean driving record.

- Multi-car discount: This discount is available to drivers who insure multiple cars with Otto.

- Homeowners discount: This discount is available to drivers who own their own home.

- Defensive driving course discount: This discount is available to drivers who have completed a defensive driving course.

- Loyalty discount: This discount is available to drivers who have been with Otto for a certain period of time.

Tips for Customers on How to Save Money on Their Car Insurance Premiums

Here are some tips for customers on how to save money on their car insurance premiums:

- Maintain a good driving record. This is the most important factor in determining your insurance premium.

- Insure multiple cars with the same company. This can often save you money on your premiums.

- Take a defensive driving course. This can help you qualify for a discount on your premium.

- Shop around for the best rates. There are many different car insurance companies out there, so it’s important to compare rates before you buy.

- Ask about discounts. Many insurance companies offer discounts for things like good grades, being a homeowner, or having a certain type of car.

Final Conclusion

In the ever-evolving landscape of car insurance, Otto Car Insurance stands tall as a pillar of stability and innovation.

Its unwavering commitment to customer satisfaction, coupled with its comprehensive coverage options and streamlined claims process, positions it as a trusted partner for drivers seeking peace of mind on the road.

As the industry continues to navigate uncharted territories, Otto Car Insurance remains poised to lead the way, embracing emerging technologies and adapting to the ever-changing needs of its customers.

Answers to Common Questions

What sets Otto Car Insurance apart from its competitors?

Otto Car Insurance distinguishes itself through its unwavering focus on customer satisfaction, innovative coverage options, and a seamless claims process.

Its commitment to transparency, personalized service, and competitive pricing has earned it a loyal customer base and industry recognition.

How does Otto Car Insurance determine insurance premiums?

Otto Car Insurance employs a sophisticated algorithm that considers various factors to determine premiums, including driving history, vehicle type, age, location, and coverage options selected.

By carefully assessing these variables, Otto ensures that each customer receives a fair and competitive rate.

What is the process for filing a claim with Otto Car Insurance?

Filing a claim with Otto Car Insurance is designed to be as hassle-free as possible. You can initiate the process online, through the mobile app, or by phone. A dedicated claims adjuster will be assigned to guide you through each step, ensuring a prompt and fair settlement.