Delve into the intricacies of Maryland car insurance with our comprehensive guide, meticulously crafted to provide a clear understanding of coverage options, factors influencing rates, and strategies for finding affordable premiums. Embark on this informative journey to safeguard your financial well-being on the road.

Navigating the complexities of Maryland car insurance can be a daunting task, but with this guide, you’ll gain a solid understanding of the essential elements, empowering you to make informed decisions about your coverage.

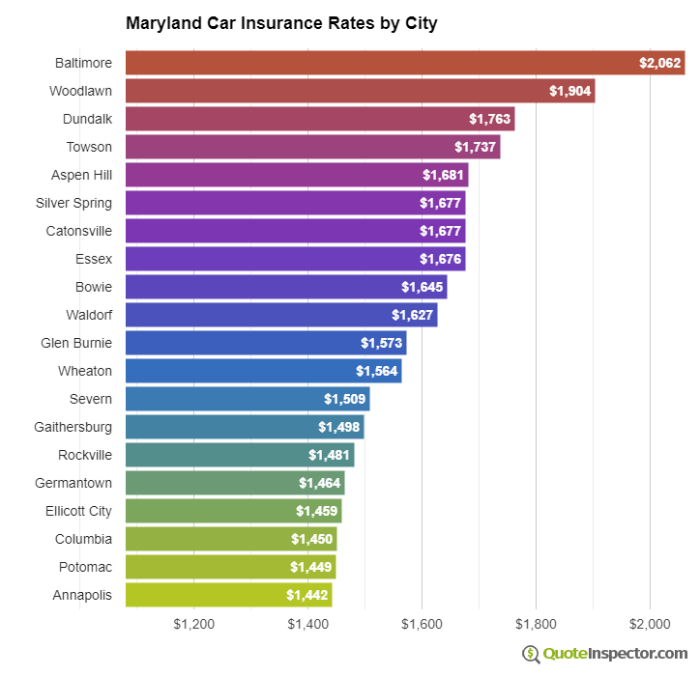

Maryland car insurance rates can vary significantly depending on factors like age, driving history, and location. To ensure you’re getting the best coverage at an affordable price, it’s essential to compare affordable car insurance quotes from multiple providers. By doing so, you can find a policy that meets your specific needs and budget, giving you peace of mind while protecting your vehicle and yourself on Maryland roads.

Overview of Maryland Car Insurance

Maryland requires drivers to carry a minimum amount of car insurance coverage. The state has a long history of regulating car insurance, and the current landscape is characterized by a competitive market with a wide range of coverage options.

For Maryland residents seeking reliable car insurance, exploring the options offered by top rated car insurance companies is crucial. These companies have consistently earned high ratings for their financial stability, customer service, and comprehensive coverage options. By comparing quotes and coverage details from various top-rated insurers, Maryland drivers can secure the best protection for their vehicles and peace of mind on the road.

Mandatory Coverage Requirements

- Bodily Injury Liability: $30,000 per person/$60,000 per accident

- Property Damage Liability: $15,000 per accident

- Personal Injury Protection (PIP): $2,500 per person

- Uninsured Motorist Bodily Injury: $30,000 per person/$60,000 per accident

Types of Maryland Car Insurance Coverage

Maryland drivers can choose from a variety of car insurance coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

Liability Coverage, Maryland car insurance

- Covers injuries and damages caused to others in an accident

- Required by law in Maryland

Collision Coverage

- Covers damages to your own vehicle in an accident

- Optional but recommended

Comprehensive Coverage

- Covers damages to your own vehicle from non-collision events, such as theft, vandalism, and natural disasters

- Optional but recommended

Uninsured/Underinsured Motorist Coverage

- Covers injuries and damages caused by drivers who are uninsured or underinsured

- Optional but highly recommended

| Coverage Type | Benefits | Limitations |

|---|---|---|

| Liability | Required by law | Only covers damages caused to others |

| Collision | Covers damages to your own vehicle | Optional |

| Comprehensive | Covers damages from non-collision events | Optional |

| Uninsured/Underinsured Motorist | Protects you from uninsured or underinsured drivers | Optional |

Closing Notes

As you navigate the roads of Maryland, rest assured that this guide has equipped you with the knowledge to make informed decisions about your car insurance. Remember, understanding your coverage options, being aware of the factors that impact your rates, and utilizing strategies for finding affordable premiums can significantly enhance your financial protection. Drive with confidence, knowing that you have the necessary coverage in place to safeguard yourself and your loved ones.

FAQ Corner: Maryland Car Insurance

What are the minimum coverage requirements for Maryland car insurance?

Maryland car insurance regulations can be complex, but understanding your coverage options is crucial. If you’re looking for a reliable and affordable option, consider exploring Otto car insurance. Otto offers competitive rates and customizable coverage plans tailored to your specific needs.

By comparing quotes from multiple providers, including Otto, you can ensure you find the best coverage for your Maryland car insurance.

Maryland requires drivers to carry a minimum of $30,000 bodily injury liability coverage per person, $60,000 bodily injury liability coverage per accident, and $15,000 property damage liability coverage.

How can I find affordable car insurance in Maryland?

To find affordable car insurance in Maryland, consider shopping around for quotes from multiple insurance companies, taking advantage of discounts, and maintaining a good driving record.

What factors affect Maryland car insurance rates?

Factors that affect Maryland car insurance rates include driving history, age, location, vehicle type, and coverage limits.