Getting car insurance can be a daunting task, but it’s essential for protecting yourself and your vehicle. This guide will walk you through the steps of how to get car insurance, from researching providers to filing a claim.

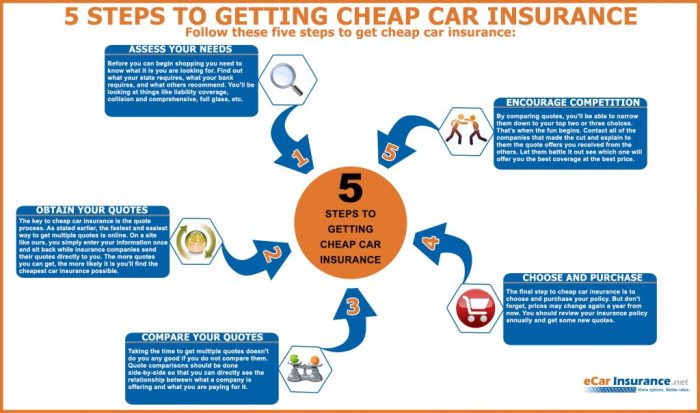

The first step is to research and compare different insurance providers. There are many different companies out there, so it’s important to find one that offers the coverage you need at a price you can afford. Once you’ve chosen a provider, you’ll need to determine your coverage needs.

How to Get Car Insurance

Obtaining car insurance is essential for responsible driving and protecting yourself financially in the event of an accident. Here’s a comprehensive guide to help you navigate the process of getting car insurance.

1. Research and Compare Insurance Providers

Comparing multiple insurance providers is crucial to find the best coverage at the most affordable price. Consider factors such as coverage options, premiums, deductibles, and customer service ratings.

2. Determine Your Coverage Needs

Assess your risk level and determine appropriate coverage limits. Consider the types of coverage available, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

3. Gather Necessary Information

Gather documents such as proof of ownership, driver’s license, and vehicle registration. Organize this information to present it effectively when applying for insurance.

4. Apply for Coverage

Apply for coverage through an online portal, over the phone, or through an insurance agent. Complete the application accurately and provide all necessary information.

5. Review and Understand Your Policy

Carefully review your policy to ensure you have the coverage you need. Understand policy terms, coverage details, and exclusions to avoid surprises.

To ensure financial protection for your vehicle, it’s essential to obtain comprehensive auto car insurance. This coverage provides peace of mind, safeguarding you against unforeseen accidents and damages.

Understanding the process of how to get car insurance is crucial, as it involves gathering necessary information, comparing quotes from multiple providers, and selecting the most suitable policy that meets your specific needs and budget.

6. Maintain Your Coverage

Keep your insurance coverage active by paying premiums on time and maintaining a valid driver’s license. Avoid allowing your insurance to lapse, as this can have serious consequences.

7. File a Claim (if necessary), How to get car insurance

In the event of an accident or other covered incident, promptly file a claim. Document the incident and interact with the insurance company to ensure a smooth claims process.

8. Additional Considerations

Consider special circumstances that may affect your insurance, such as high-risk drivers or modified vehicles. Explore ways to save money on insurance, such as discounts and loyalty programs.

Obtaining car insurance is essential for responsible driving, and finding the best and cheapest option is crucial. Fortunately, there are resources available to assist you in comparing quotes and selecting the most cost-effective coverage.

By exploring the best and cheapest car insurance options, you can ensure you have the necessary protection without breaking the bank.

Researching and comparing policies will empower you to make an informed decision and secure the most suitable insurance for your needs.

Wrap-Up

Getting car insurance is an important part of being a responsible driver. By following the steps Artikeld in this guide, you can ensure that you have the coverage you need to protect yourself and your vehicle.

To obtain car insurance, research and compare policies from multiple providers. To simplify the process, utilize free car insurance quotes online, allowing you to swiftly and easily compare coverage options and premiums.

After selecting the most suitable policy, finalize your purchase to secure your vehicle and protect yourself financially in the event of an accident.

Frequently Asked Questions: How To Get Car Insurance

What is car insurance?

Car insurance is a type of insurance that protects you and your vehicle in the event of an accident. It can cover the cost of repairs, medical expenses, and lost wages.

How much does car insurance cost?

The cost of car insurance varies depending on a number of factors, including your age, driving history, and the type of car you drive. However, you can expect to pay between $500 and $1,000 per year for car insurance.

What are the different types of car insurance coverage?

There are many different types of car insurance coverage available, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. It’s important to choose the coverage that’s right for you and your needs.