How much should car insurance cost – Determining how much car insurance should cost can be a complex task, influenced by a multitude of factors. From driving history and age to location and vehicle type, understanding these variables is crucial for navigating the insurance landscape and securing appropriate coverage at a reasonable price.

In this comprehensive guide, we delve into the intricacies of car insurance costs, exploring the different types of coverage available, comparing insurance providers, and uncovering effective strategies for saving money.

Whether you’re a first-time driver or a seasoned motorist, this guide will empower you to make informed decisions about your car insurance, ensuring you have the protection you need without breaking the bank.

Factors Affecting Car Insurance Costs

The cost of car insurance varies depending on a range of factors, including:

Driving History

- Drivers with clean driving records typically pay lower premiums than those with accidents or traffic violations.

- Insurance companies assess risk based on the likelihood of an accident occurring.

Age, How much should car insurance cost

- Younger drivers are often considered higher-risk and pay higher premiums.

- As drivers gain experience and age, their premiums may decrease.

Location

- Insurance rates vary by location based on factors such as crime rates, population density, and road conditions.

- Urban areas generally have higher insurance costs than rural areas.

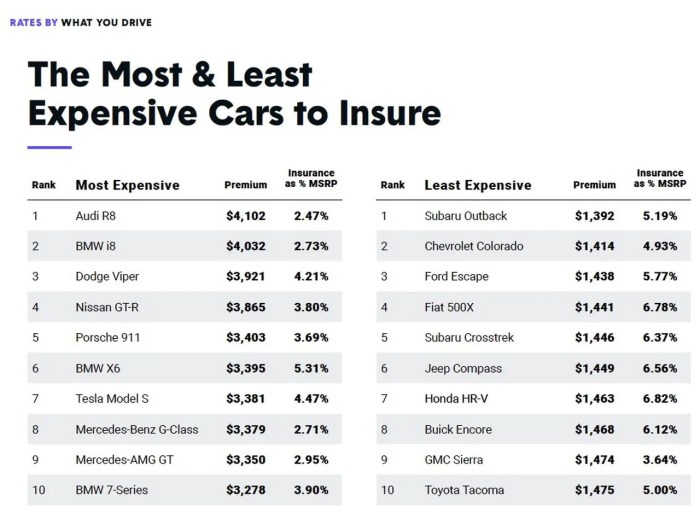

Vehicle Type

- Sports cars, luxury vehicles, and high-performance cars typically have higher insurance premiums.

- Vehicles with advanced safety features may qualify for discounts.

Coverage Options and Costs

Car insurance coverage options include:

Liability Coverage

- Covers damages to other vehicles and property in an accident you cause.

- Required by law in most states.

Collision Coverage

- Covers damages to your own vehicle in an accident.

- Optional but recommended for newer vehicles or those with a loan.

Comprehensive Coverage

- Covers non-accident-related damages, such as theft, vandalism, and weather events.

- Optional but recommended for vehicles parked in high-crime areas or subject to severe weather.

Deductible

The amount you pay out of pocket before insurance coverage kicks in. Higher deductibles typically result in lower premiums.

Coverage Limits

The maximum amount the insurance company will pay for damages. Higher coverage limits increase premiums.

Comparing Insurance Providers: How Much Should Car Insurance Cost

To compare insurance quotes, consider the following:

Coverage

- Make sure the policies provide the coverage you need.

- Compare coverage limits, deductibles, and any exclusions.

Price

- Get quotes from multiple providers to find the best rates.

- Consider discounts and promotions offered by different companies.

Customer Service

- Check online reviews and ask for recommendations.

- Consider the ease of filing claims and the responsiveness of customer support.

Resources for Comparing Quotes

- Insurance comparison websites

- Insurance agents

Saving Money on Car Insurance

Ways to reduce car insurance costs include:

Maintain a Good Driving Record

- Avoid accidents and traffic violations.

- Enroll in defensive driving courses to improve driving skills.

Bundle Policies

- Combine car insurance with other policies, such as home or renters insurance.

- Insurance companies often offer discounts for bundling.

Negotiate with Insurance Companies

- Call your insurance company and ask for a review of your rates.

- Explain your driving record and other factors that may justify a lower premium.

Telematics Devices and Pay-as-You-Drive Programs

- Telematics devices track driving behavior and can reward safe drivers with discounts.

- Pay-as-you-drive programs charge premiums based on the miles driven.

Conclusive Thoughts

Ultimately, the cost of car insurance is a multifaceted issue that requires careful consideration of individual circumstances and financial goals.

By understanding the factors that influence premiums, comparing quotes from multiple providers, and implementing cost-saving measures, you can navigate the insurance market with confidence, securing the coverage you need at a price that fits your budget.

Question & Answer Hub

What are the main factors that affect car insurance costs?

To determine the appropriate cost of car insurance, it’s crucial to understand what constitutes good car insurance. Good car insurance provides comprehensive coverage, including liability, collision, and comprehensive protection.

By considering these factors, you can assess the value of different insurance policies and make an informed decision on how much car insurance should cost for your specific needs.

Driving history, age, location, vehicle type, and coverage options are the primary factors that influence car insurance premiums.

The cost of car insurance varies widely depending on factors like age, driving history, and location. To get the best rates, it’s recommended to compare quotes from multiple car insurance places near me.

This will help ensure you’re getting the coverage you need at a price that fits your budget.

How can I compare insurance quotes effectively?

Consider coverage options, price, customer service, and use resources or tools for comparing insurance rates.

The cost of car insurance can vary greatly depending on a number of factors, including the type of car you drive. If you’re looking to save money on your insurance premiums, consider getting a car that’s known for being cheap to insure.

Some of the cheapest cars to insure include the Toyota Corolla, the Honda Civic, and the Hyundai Elantra. These cars are all known for being reliable and affordable, which makes them a good choice for drivers who are looking to save money on their car insurance.

What are some ways to save money on car insurance?

Maintain a good driving record, bundle policies, negotiate with insurance companies, and consider telematics devices or pay-as-you-drive programs.