As the question “how much does car insurance cost” takes center stage, this opening passage beckons readers into a world crafted with deep knowledge, ensuring a reading experience that is both absorbing and distinctly original. Prepare to delve into the intricacies of car insurance costs, deciphering the factors that shape premiums and empowering you with strategies to optimize your coverage.

Factors Influencing Car Insurance Costs

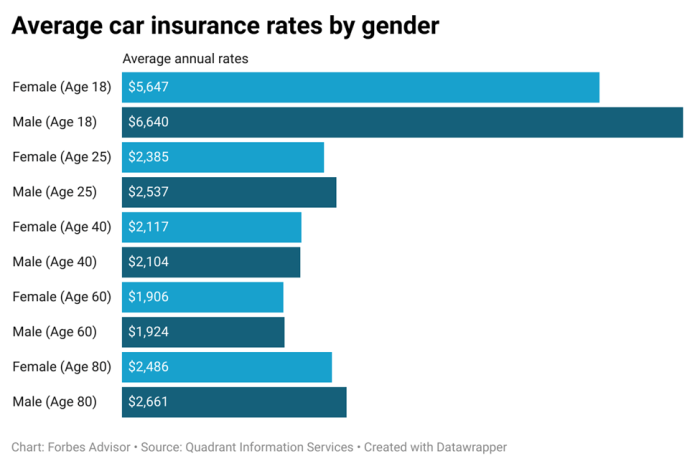

The cost of car insurance is influenced by a variety of factors, including age, gender, driving history, and location. Younger drivers, for example, are typically charged higher premiums than older drivers, as they are statistically more likely to be involved in accidents.

Similarly, male drivers tend to pay more for car insurance than female drivers, as they are also more likely to be involved in accidents.

The cost of car insurance can vary greatly depending on a number of factors, including the type of car you drive, your driving history, and your location. For example, drivers in New Jersey typically pay more for car insurance than drivers in other states.

This is because New Jersey has a high rate of accidents and a dense population, which can lead to higher insurance premiums.

However, there are a number of ways to save money on car insurance in New Jersey, such as by shopping around for the best rates and by taking advantage of discounts for things like good driving records and multiple policies.

Car insurance in New Jersey can be affordable if you take the time to compare quotes and find the right policy for your needs.

Driving history also plays a significant role in determining car insurance premiums. Drivers with clean driving records will typically pay less for insurance than drivers with multiple accidents or traffic violations.

Location is another important factor, as insurance rates can vary significantly from state to state. This is due to differences in state laws and regulations, as well as the number of accidents and claims in a given area.

In addition to these factors, credit scores and claims history can also affect car insurance rates. Drivers with poor credit scores may be charged higher premiums, as they are considered to be a higher risk. Similarly, drivers who have filed multiple claims in the past may also be charged higher premiums.

Types of Car Insurance Coverage

There are a variety of different types of car insurance coverage available, each with its own benefits and limitations. The most common types of coverage include:

- Liability coverage: This coverage protects you from financial responsibility if you cause an accident that results in bodily injury or property damage to others.

- Collision coverage: This coverage pays for damage to your own vehicle if you are involved in an accident, regardless of who is at fault.

- Comprehensive coverage: This coverage pays for damage to your own vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This coverage protects you from financial losses if you are involved in an accident with a driver who is uninsured or underinsured.

When choosing car insurance coverage, it is important to consider your individual needs and budget. You should also make sure that you understand the coverage limits and deductibles for each type of coverage.

Methods for Reducing Car Insurance Costs: How Much Does Car Insurance Cost

There are a number of ways to reduce car insurance costs, including:

- Maintain a good driving record: One of the best ways to reduce your car insurance premiums is to maintain a clean driving record. This means avoiding accidents and traffic violations.

- Increase your deductible: The deductible is the amount of money you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lower your premiums, but it is important to make sure that you can afford to pay the deductible if you need to.

- Bundle your policies: Many insurance companies offer discounts if you bundle your car insurance with other types of insurance, such as home insurance or renters insurance.

You can also shop around for the best car insurance rates. By comparing quotes from multiple insurers, you can find the best coverage at the lowest price.

Car insurance costs can vary significantly depending on a range of factors. If you’re looking for a comprehensive solution to protect your vehicle, auto car insurance offers a wide range of coverage options.

Understanding the factors that influence insurance costs, such as driving history and vehicle type, can help you make informed decisions about your coverage needs and ensure you’re getting the best value for your money.

State-Specific Regulations and Costs

Car insurance costs can vary significantly from state to state. This is due to differences in state laws and regulations, as well as the number of accidents and claims in a given area.

| State | Average Annual Premium |

|---|---|

| California | $1,911 |

| Florida | $1,722 |

| Texas | $1,548 |

| New York | $1,458 |

| Pennsylvania | $1,298 |

As you can see, car insurance costs can vary by hundreds of dollars from state to state. When shopping for car insurance, it is important to compare quotes from multiple insurers to find the best coverage at the lowest price.

Industry Trends and Future Outlook

The car insurance industry is constantly evolving, with new trends emerging all the time. One of the most significant trends in recent years is the rise of autonomous vehicles.

As autonomous vehicles become more common, it is likely that car insurance rates will decline, as these vehicles are less likely to be involved in accidents.

Another trend that is likely to affect car insurance rates in the future is the use of telematics. Telematics devices track driving behavior, and this data can be used by insurance companies to determine premiums.

Drivers who are considered to be safe drivers may be eligible for discounts on their car insurance.

The future of the car insurance industry is uncertain, but it is clear that technology will play a major role in shaping the industry. As new technologies emerge, it is likely that car insurance rates will continue to decline.

Epilogue

In the realm of car insurance, understanding the factors that influence costs is paramount. From age and driving history to location and coverage limits, every element plays a crucial role in determining premiums.

This comprehensive guide unravels the complexities of car insurance, empowering you with the knowledge to make informed decisions and safeguard your financial well-being on the road.

FAQ Summary

What factors influence car insurance costs?

Age, gender, driving history, location, credit score, and claims history all impact insurance premiums.

What types of car insurance coverage are available?

Liability, collision, comprehensive, and uninsured/underinsured motorist coverage are common types of car insurance coverage.

The cost of car insurance varies depending on several factors, including your age, driving history, and the type of car you drive. If you’re looking for an accurate estimate of how much you’ll pay for car insurance, you can get car insurance quotes from multiple insurance companies.

By comparing quotes, you can find the best deal on car insurance that meets your needs and budget.

How can I reduce my car insurance costs?

Maintaining a good driving record, increasing deductibles, bundling policies, and comparing quotes from multiple insurers can help lower premiums.