Car insurance new jersey – Navigating the world of car insurance in New Jersey can be daunting, but with the right guidance, you can secure the coverage you need at a price you can afford. This comprehensive guide delves into the legal requirements, reputable providers, coverage options, discounts, and the claims process, empowering you to make informed decisions and protect yourself on the road.

Car Insurance Regulations in New Jersey

In New Jersey, driving without car insurance is illegal. The state requires all drivers to maintain a minimum level of liability coverage to protect themselves and others on the road.

Minimum Coverage Requirements, Car insurance new jersey

- Bodily injury liability: $15,000 per person, $30,000 per accident

- Property damage liability: $5,000 per accident

Policy Types

- Liability-only insurance: Covers only the minimum required liability coverage.

- Collision insurance: Covers damage to your own vehicle in an accident.

- Comprehensive insurance: Covers damage to your vehicle from non-collision events, such as theft or vandalism.

Unique Regulations

- New Jersey has a “no-fault” car insurance system, which means that drivers are responsible for their own medical expenses and lost wages, regardless of who is at fault for an accident.

- New Jersey drivers are required to carry proof of insurance in their vehicles at all times.

Finding the Right Car Insurance Company

With numerous car insurance companies operating in New Jersey, finding the right one can be a challenge. Here are some tips to help you make an informed decision:

Factors to Consider

- Coverage options: Make sure the company offers the coverage you need, including liability, collision, and comprehensive.

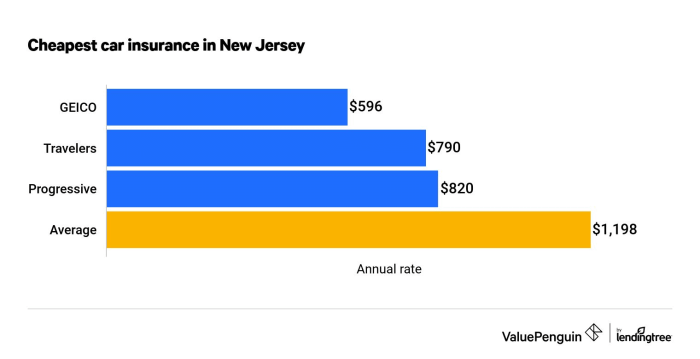

- Rates: Compare rates from different companies to find the best deal.

- Customer service: Look for a company with a good reputation for customer service.

Reputable Insurance Providers

- Geico

- State Farm

- Progressive

- Allstate

- USAA

Coverage Options and Add-Ons

In addition to the minimum required liability coverage, there are a variety of optional coverage options available in New Jersey. These include:

Liability Coverage

Protects you from financial responsibility for injuries or property damage you cause to others in an accident.

Collision Coverage

Covers damage to your own vehicle in an accident, regardless of who is at fault.

When exploring car insurance options in New Jersey, it’s crucial to consider your proximity to insurance providers. Fortunately, numerous car insurance places near you offer a wide range of coverage options to meet your specific needs.

Find local car insurance places that can provide personalized guidance and competitive rates.

By researching and comparing options, you can secure the most suitable car insurance policy for your situation in New Jersey.

Comprehensive Coverage

Covers damage to your vehicle from non-collision events, such as theft or vandalism.

Optional Add-Ons

- Rental car reimbursement

- Roadside assistance

- Gap insurance

- Personal injury protection (PIP)

Discounts and Savings: Car Insurance New Jersey

There are several ways to save money on car insurance in New Jersey. Some common discounts include:

Safe Driver Discounts

- Good driver discount

- Accident-free discount

Multi-Car Discounts

Insuring multiple vehicles with the same company can save you money.

Car insurance in New Jersey can be a significant expense, but there are ways to find affordable options. One way is to compare quotes from different insurance companies.

Another way is to consider raising your deductible. If you can afford to pay a higher deductible, you’ll likely pay a lower premium.

You can also save money on car insurance by taking advantage of discounts for things like good driving records and multiple policies.

To learn more about finding affordable car insurance, visit car insurance affordable. In New Jersey, there are a number of companies that offer affordable car insurance options, so it’s important to shop around and compare quotes to find the best deal.

Loyalty Discounts

Some companies offer discounts to customers who remain with them for a certain period of time.

Filing a Claim

If you are involved in an accident, you should file a claim with your insurance company as soon as possible.

Steps to File a Claim

- Report the accident to your insurance company.

- Gather evidence, such as photos of the damage and a police report.

- Submit your claim to your insurance company.

Tips for Navigating the Claims Process

- Be honest and accurate when reporting the accident.

- Keep a record of all communication with your insurance company.

- Don’t accept the first settlement offer without consulting an attorney.

Closing Summary

Understanding car insurance in New Jersey is crucial for responsible driving and financial protection. By following the insights Artikeld in this guide, you can find the right coverage, maximize savings, and navigate the claims process with confidence.

Remember, car insurance is not just a legal requirement; it’s an investment in your peace of mind and financial well-being.

If you’re looking for car insurance in New Jersey, it’s important to compare quotes from different providers to get the best rate. One option to consider is Progressive, which offers a range of coverage options and discounts.

You can get a quote or contact Progressive directly by calling the progressive car insurance phone number.

When comparing quotes, be sure to consider the coverage limits, deductibles, and any additional features that may be important to you. By shopping around and comparing quotes, you can find the best car insurance policy for your needs and budget in New Jersey.

Questions and Answers

What are the minimum car insurance requirements in New Jersey?

New Jersey requires drivers to carry a minimum of $15,000 in bodily injury liability coverage per person, $30,000 per accident, and $5,000 in property damage liability coverage.

How can I find the best car insurance company in New Jersey?

Compare quotes from multiple insurance providers, considering factors such as coverage options, rates, customer service, and financial stability.

What coverage options are available for car insurance in New Jersey?

Common coverage options include liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection.

How can I save money on car insurance in New Jersey?

Take advantage of discounts such as safe driver discounts, multi-car discounts, and loyalty discounts. Consider raising your deductible to lower your premiums.

What is the process for filing a car insurance claim in New Jersey?

Report the accident to your insurance company promptly. Provide documentation such as a police report and photos. Cooperate with the claims adjuster throughout the process.