Best insurance for cars – Navigating the world of car insurance can be daunting, but understanding your options and choosing the right policy is crucial for protecting your vehicle and finances. Dive into our comprehensive guide to find the best insurance for your car and ensure peace of mind on the road.

From coverage options to insurance providers, premiums to discounts, and additional features, we’ll cover everything you need to know to make informed decisions about your car insurance.

1. Coverage Options

Car insurance coverage options provide financial protection against various risks associated with owning and operating a vehicle. Understanding the different types of coverage and selecting the right ones for your needs is crucial to ensure adequate protection in the event of an accident or other covered event.

Liability Coverage

Liability coverage protects you from financial responsibility if you cause an accident that results in injuries or property damage to others. It covers medical expenses, lost wages, pain and suffering, and legal fees for the injured party.

Collision Coverage

Collision coverage pays for repairs or replacement of your own vehicle if it is damaged in a collision with another vehicle or object, regardless of fault.

Comprehensive Coverage

Comprehensive coverage provides protection against non-collision events, such as theft, vandalism, fire, hail, and natural disasters. It covers the actual cash value of your vehicle at the time of the loss.

Finding the best insurance for your car can be a daunting task, especially for young drivers. Young drivers face higher insurance premiums due to their lack of experience behind the wheel.

However, there are specific insurance policies designed for young drivers that can provide affordable coverage.

Best car insurance for young drivers typically includes lower deductibles and higher coverage limits to protect young drivers in the event of an accident.

By researching and comparing different insurance options, young drivers can find the best insurance for their needs and budget, ensuring they are adequately protected on the road.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your damages.

Finding the best insurance for your car can be a daunting task. With so many options available, it’s important to do your research and compare quotes from different providers. One way to get started is to get an insurance car quote.

This will give you a good idea of the coverage and costs associated with different policies. Once you have a few quotes, you can compare them side-by-side to find the best deal for your needs.

2. Insurance Providers

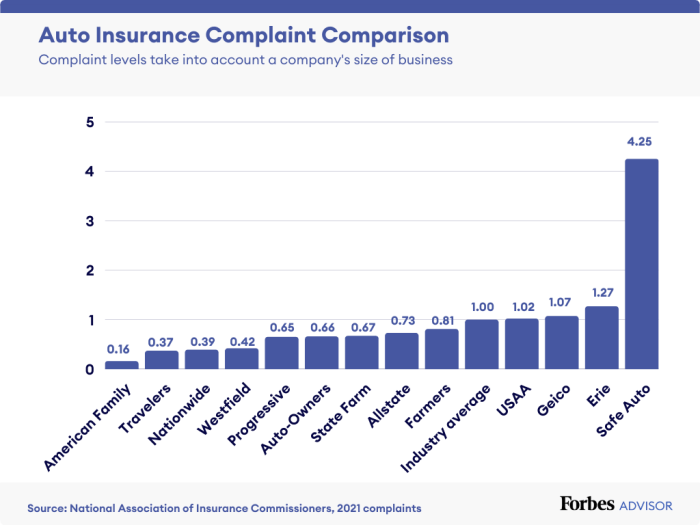

Choosing the right car insurance provider is essential to ensure reliable protection and efficient claims handling. Here are some reputable providers and their key strengths and weaknesses:

- Progressive: Known for affordable rates, discounts, and innovative features like Snapshot, which monitors driving behavior for potential savings.

- Geico: Offers competitive rates, a strong mobile app, and a good reputation for customer service.

- State Farm: Provides comprehensive coverage options, local agents, and a long history of financial stability.

- Allstate: Focuses on providing personalized coverage, including identity theft protection and accident forgiveness programs.

- USAA: Exclusively serves military members and their families, offering tailored coverage and discounts.

Consider factors such as financial stability, customer satisfaction ratings, and claims processing efficiency when comparing insurance providers.

3. Premiums and Discounts

Car insurance premiums are calculated based on factors such as your driving history, vehicle type, location, and coverage options. Understanding how premiums are determined and exploring ways to save money can help you optimize your insurance costs.

Factors Affecting Premiums

- Driving history (accidents, violations)

- Vehicle type (make, model, safety features)

- Location (crime rates, traffic congestion)

- Coverage options (deductible, limits)

Discounts for Savings

- Good driving record

- Multiple vehicles on the same policy

- Safety features (anti-lock brakes, airbags)

- Defensive driving courses

- Loyalty discounts

Balancing higher premiums with lower deductibles is important. A higher deductible lowers your premium but increases your out-of-pocket costs in the event of a claim.

4. Claims Process

Filing a car insurance claim is a necessary step after an accident. Understanding the process and following the correct procedures can ensure a smooth and efficient resolution.

Steps Involved

- Report the accident to your insurance company promptly.

- Document the accident with photos, police reports, and witness statements.

- Cooperate with the insurance adjuster during the investigation.

- Submit a detailed claim form and supporting documentation.

- Receive payment for covered damages.

Tips for a Successful Claim, Best insurance for cars

- Stay calm and collect information at the scene of the accident.

- Communicate clearly and provide all necessary details to the insurance company.

- Keep records of all expenses and documentation related to the claim.

- Follow up regularly to check on the status of your claim.

5. Additional Features and Services: Best Insurance For Cars

Some car insurance providers offer additional features and services that can enhance your insurance experience and provide peace of mind.

Roadside Assistance

Roadside assistance provides 24/7 support for common vehicle issues, such as flat tires, dead batteries, and lockouts.

Accident Forgiveness

Accident forgiveness programs waive the surcharge that typically applies after an at-fault accident, protecting your premium rates.

Telematics Programs

Telematics programs use devices installed in your vehicle to monitor driving behavior and provide personalized feedback, discounts, and usage-based insurance options.

For car owners seeking comprehensive coverage, it’s crucial to explore the best insurance options. Among the specialized policies available is military car insurance , designed specifically for active military personnel and veterans.

By tailoring their policies to the unique needs of service members, military car insurance providers offer exclusive benefits and discounts.

Whether you’re navigating civilian roads or military bases, securing the best insurance for your car is essential for peace of mind.

Consider the potential costs and benefits of these additional services when selecting an insurance provider.

Last Word

Whether you’re a new driver or a seasoned veteran, finding the best insurance for your car is essential for safeguarding your investment and financial well-being.

By understanding your coverage options, comparing providers, and taking advantage of discounts, you can secure the right policy that meets your needs and provides peace of mind.

Question Bank

What is the most important type of car insurance coverage?

Liability coverage is the most important type of car insurance as it protects you from financial responsibility if you cause an accident that injures others or damages their property.

How can I save money on car insurance?

There are several ways to save money on car insurance, including maintaining a good driving record, taking advantage of discounts for multiple vehicles or safety features, and bundling your insurance policies.

What should I do if I’m involved in an accident?

If you’re involved in an accident, it’s important to stay calm and follow the proper steps to file a claim. This includes reporting the accident to your insurance company, documenting the scene, and exchanging information with the other driver(s) involved.