Car and Home Insurance – where protecting your valuable possessions and securing your peace of mind are essential priorities. This comprehensive guide will take you through the best car and home insurance companies, equipping you with the knowledge to make informed decisions about safeguarding what matters most.

As we navigate through the complexities of the insurance industry, we’ll explore the key players, understand the nuances of customer segmentation, compare product offerings, and examine various distribution channels. We’ll also take a closer look at pricing strategies, the claims process, and the role that technology plays in shaping the industry’s future. Whether you’re a homeowner, a driver, or both, this guide will help you make sound choices in selecting the best insurance coverage for your needs.

Table of Contents

ToggleMarket Overview

The car and home insurance industry is massive and continuously evolving. In the United States alone, this industry generated over $400 billion in premiums in 2020. As the population grows, car ownership rises, and home values increase, this sector is expected to expand further in the coming years.

While growth is steady, the industry faces a few challenges, such as rising operational costs, intense competition, and ever-changing regulatory requirements.

On the flip side, several trends are positively shaping the market. The use of technology—whether through mobile apps, telematics, or artificial intelligence—has made insurance services more accessible and efficient. Personalized insurance products, which cater to specific needs, are also in high demand, further driving innovation in the sector.

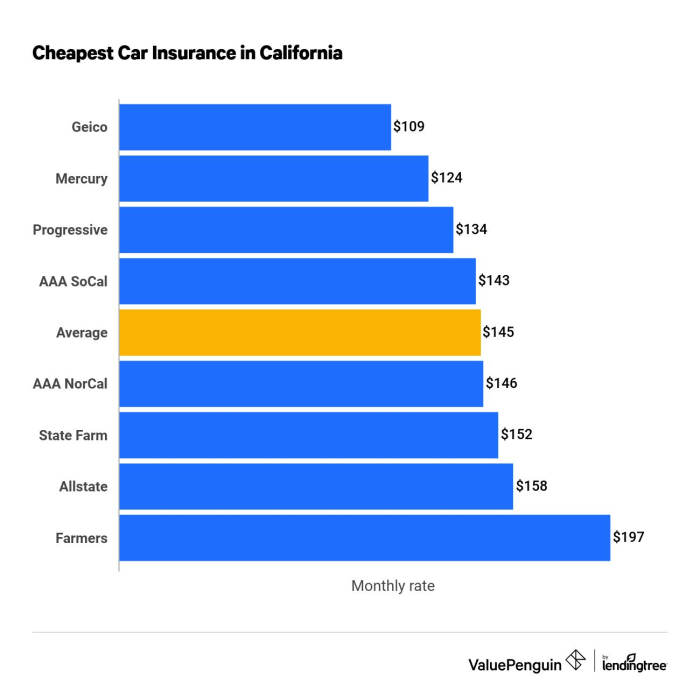

Among the major players in the car and home insurance market are State Farm, Geico, Progressive, and Allstate. These companies hold a significant market share, offering a broad range of insurance products and services. While these large companies dominate, smaller insurers have carved out niches by offering unique products or personalized service.

Customer Segmentation

The car and home insurance market serves a wide range of customers, each with distinct needs and preferences. Key customer segments include:

- Young Drivers: Typically those under the age of 25, this group is often considered high-risk due to limited driving experience. As a result, young drivers tend to face higher premiums. However, several insurance companies offer discounts for good driving behavior, participation in driver education programs, or bundling with other family policies.

- Families: Families often require both car and home insurance, with an emphasis on comprehensive coverage. Home insurance is essential for protecting their primary residence and belongings, while auto insurance ensures that multiple family members are covered for accidents and liabilities. Families often benefit from multi-policy discounts offered by many insurers.

- Seniors: This segment typically includes retirees who may drive less but have specific needs when it comes to home insurance, especially in cases where they own homes outright or have more substantial property assets. Insurance companies sometimes offer senior discounts for both car and home insurance. Additionally, older adults may prioritize long-term care or umbrella insurance policies for extra liability protection.

- Renters: While renters don’t need homeowners insurance, they require renters insurance, which covers personal belongings and liability. Many car insurance companies also offer renters insurance, and bundling these policies can lead to discounts.

- Homeowners: As one of the primary target audiences for home insurance, homeowners need coverage for their property, personal possessions, and liability. Depending on the location of the home, flood, hurricane, or earthquake insurance may also be necessary.

Each of these customer segments has unique characteristics that influence the type of coverage they need and the level of premiums they can expect. For example, young drivers are statistically more likely to be involved in accidents, which often leads to higher insurance costs. Seniors, on the other hand, may need coverage tailored to their retirement lifestyle and potential healthcare needs.

Understanding the nuances of customer segmentation allows insurance providers to offer targeted products and personalized coverage, ensuring that each segment’s specific needs are met.

Product Offerings

Car and home insurance companies provide a variety of products designed to meet the unique needs of different customers. The most common types of car insurance policies include:

- Liability Insurance: Covers damages or injuries you may cause to others in an accident.

- Collision Insurance: Covers damages to your vehicle resulting from a collision.

- Comprehensive Insurance: Provides protection against non-collision-related events such as theft, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Covers damages or injuries caused by a driver with little or no insurance.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers, regardless of fault.

Home insurance policies, on the other hand, offer different types of coverage such as:

- Dwelling Coverage: Protects the physical structure of your home from perils like fire, windstorms, or vandalism.

- Personal Property Coverage: Covers personal belongings, including furniture, electronics, and clothing.

- Liability Coverage: Provides financial protection if someone is injured on your property.

- Loss of Use Coverage: Pays for living expenses if you’re temporarily displaced from your home due to covered damages.

- Flood Insurance: A separate policy often required in flood-prone areas to cover water damage.

In addition to these standard policies, most insurance providers offer optional add-ons (or riders) that allow policyholders to customize their coverage. For example, you can add coverage for valuable items such as jewelry, or opt for increased liability limits for more comprehensive protection.

Distribution Channels

Car and home insurance policies are distributed through various channels. The most common include:

- Direct Writers: These are insurance companies that sell directly to consumers through online platforms, phone lines, or proprietary agents. Direct writers often have lower premiums since there’s no middleman, but they may lack the personal touch that some customers prefer.

- Independent Agents: These agents represent multiple insurance companies and can offer customers a range of quotes from different providers. Independent agents often provide a more personalized service, helping clients compare policies and coverage options.

- Brokers: Insurance brokers act as intermediaries between consumers and insurance companies. Unlike agents, brokers typically work for the consumer, seeking out the best deals and coverage options. While brokers can offer valuable expertise, their services often come at an additional cost.

Each distribution channel has its own advantages and disadvantages. Direct writers tend to offer lower prices, but they may not provide the same level of tailored advice that independent agents or brokers can offer.

Conversely, working with an independent agent or broker may result in higher premiums, but you benefit from expert advice and access to a broader range of options.

Pricing and Claims Process

One of the most important factors when choosing car and home insurance is the cost. The price of car insurance can vary greatly depending on factors such as your age, driving record, and location.

For instance, young drivers or those living in areas with high accident rates often face higher premiums. Researching how much car insurance should cost in your region and for your demographic can help you find the most competitive rates.

The claims process is another crucial aspect of selecting an insurance provider. In the event of an accident or home damage, you’ll want a company that handles claims efficiently and fairly.

The typical claims process involves reporting the incident, submitting documentation (such as photos, repair estimates, or medical bills), and working with an adjuster to determine the coverage and payout. Reading customer reviews and checking satisfaction ratings can give you a sense of how different companies handle claims.

The Role of Technology

In recent years, technology has transformed the insurance industry. Many insurance companies now offer mobile apps that allow policyholders to manage their accounts, file claims, and even track driving habits to earn discounts.

Telematics, which involves tracking driving behavior via GPS and other sensors, has become a popular tool for offering usage-based insurance (UBI) programs, where premiums are based on actual driving habits.

Artificial intelligence (AI) and machine learning are also being used to streamline the claims process, detect fraud, and provide personalized insurance quotes. These advancements not only improve efficiency but also allow for greater customization of policies to meet individual needs.

Conclusion

Choosing the right car and home insurance is about more than just finding the lowest premium. It’s about selecting a company that offers the right balance of coverage, affordability, and customer service. By understanding the market, exploring your options, and comparing quotes, you can find the best policy to protect your home, car, and financial well-being. Ultimately, insurance is about peace of mind—knowing that you and your loved ones are protected when life’s unexpected events occur.