Auto car insurance is a crucial aspect of responsible driving, providing financial protection against unexpected accidents and other risks on the road. Understanding the types of coverage available, factors influencing rates, and the claims process is essential for making informed decisions and ensuring adequate coverage.

This comprehensive guide delves into the intricacies of auto car insurance, empowering you to navigate the complexities of coverage options, costs, and claims.

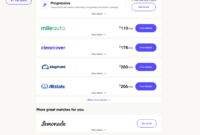

Auto car insurance offers financial protection for your vehicle in case of accidents, theft, or damage. To find the best coverage for your needs, consider comparing online car insurance quotes.

These quotes provide instant comparisons of coverage options and premiums from multiple insurance providers, making it easy to find the right auto car insurance policy that fits your budget and coverage requirements.

Auto Insurance Coverage Types

Auto insurance provides financial protection against risks associated with owning and operating a vehicle. Different types of coverage are available to meet the varying needs of drivers.

Liability Coverage

- Covers damages caused to others (property or injuries) as a result of an accident you cause.

- Mandatory in most states.

- Limits are typically expressed as three numbers (e.g., 100/300/50), representing thousands of dollars of coverage.

Collision Coverage

- Covers damages to your own vehicle in the event of a collision with another object (e.g., car, tree).

- Optional but recommended for vehicles with a loan or lease.

- Deductible applies, which is the amount you pay out-of-pocket before coverage kicks in.

Comprehensive Coverage

- Covers damages to your vehicle from non-collision events (e.g., theft, vandalism, natural disasters).

- Optional but recommended for newer or expensive vehicles.

- Deductible applies, similar to collision coverage.

Uninsured/Underinsured Motorist Coverage

- Protects you from financial losses if you are involved in an accident with an uninsured or underinsured driver.

- Optional but highly recommended, as uninsured drivers are common.

- Limits are typically expressed in the same way as liability coverage.

Factors Affecting Auto Insurance Rates

Insurance companies consider various factors when determining auto insurance rates, impacting the cost of premiums.

Auto car insurance offers financial protection against potential liabilities and damages associated with owning and operating a vehicle. However, the cost of car insurance can vary significantly, depending on various factors.

To better understand the factors that influence car insurance costs, it’s recommended to explore reputable sources such as car insurance cost comparisons.

This can help drivers make informed decisions about their coverage and ensure they are adequately protected while minimizing unnecessary expenses.

Age

Younger drivers typically pay higher rates due to higher risk and lack of driving experience.

Driving History

Accidents, traffic violations, and DUIs can significantly increase insurance rates.

Vehicle Type

Sports cars, luxury vehicles, and high-performance vehicles generally carry higher rates due to their increased risk of accidents and repair costs.

Location

Areas with high accident rates, traffic congestion, and theft have higher insurance premiums.

Shopping for Auto Insurance

Comparing quotes from multiple providers is crucial to finding the best auto insurance policy for your needs.

Tips, Auto car insurance

- Gather necessary information (e.g., driver’s license, vehicle registration, driving history).

- Compare quotes from at least three different providers.

- Understand the terms and conditions of each policy.

Role of Agents and Brokers

Insurance agents and brokers can assist in comparing quotes, explaining coverage options, and navigating the insurance process.

Claims Process and Disputes

Filing an auto insurance claim involves several steps and potential disputes.

Steps

- Report the accident to your insurance company promptly.

- Gather evidence (e.g., police report, witness statements, photos).

- Submit documentation and cooperate with the claims adjuster.

Disputes

Disputes may arise regarding the amount of coverage, liability, or fault. In such cases, it’s advisable to:

- Review your policy and understand your coverage.

- Negotiate with the insurance company or consider mediation.

- File a formal complaint with the state insurance regulator if necessary.

Ultimate Conclusion

In conclusion, auto car insurance is a multifaceted subject that requires careful consideration and understanding. By familiarizing yourself with the different types of coverage, factors affecting rates, and the claims process, you can make informed decisions that safeguard you financially and ensure peace of mind while driving.

Detailed FAQs: Auto Car Insurance

What are the most common types of auto insurance coverage?

Liability, collision, comprehensive, and uninsured/underinsured motorist coverage are the most common types of auto insurance coverage.

Auto car insurance is a must-have for any car owner, providing financial protection in case of accidents. If you’re looking for affordable car insurance quotes, it’s worth comparing options from different providers.

By doing so, you can find the best coverage for your needs at a price that fits your budget.

Check out affordable car insurance quotes to find the best deal on auto car insurance.

What factors influence auto insurance rates?

Age, driving history, vehicle type, and location are key factors that influence auto insurance rates.

What are the steps involved in filing an auto insurance claim?

Reporting the accident, gathering evidence, and submitting documentation are the key steps involved in filing an auto insurance claim.