Navigating the world of quotes insurance car can be a daunting task, but understanding the basics can empower you to make informed decisions. This comprehensive guide delves into the intricacies of car insurance quotes, providing you with the knowledge and tools to secure the optimal coverage for your needs.

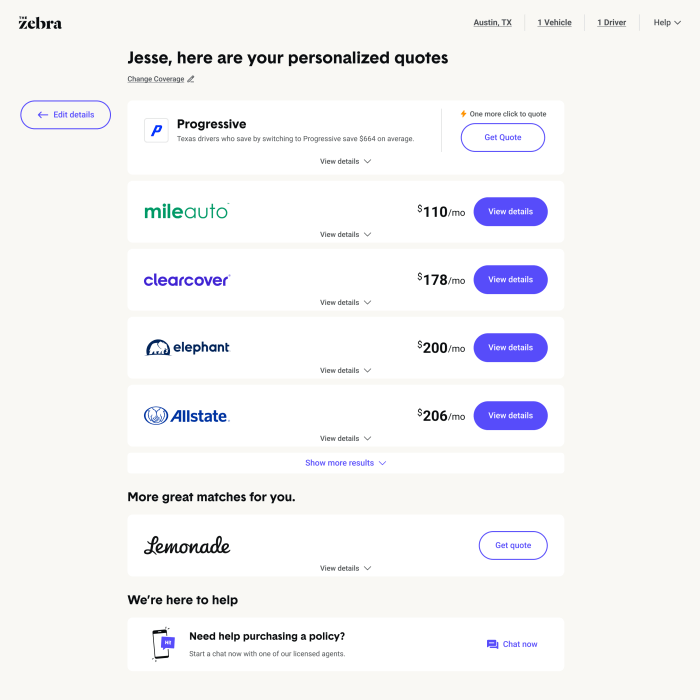

When it comes to finding the right car insurance policy, getting quotes is essential. By comparing quotes from different providers, you can ensure you’re getting the best coverage at the most affordable price. For those looking for inexpensive car insurance near them, there are numerous options available.

Explore inexpensive car insurance near me to find providers offering competitive rates and tailored coverage plans that meet your specific needs and budget. By doing so, you can secure peace of mind knowing you have the right car insurance protection without breaking the bank.

From understanding the factors that influence quotes to comparing different options, we’ll guide you through the entire process, ensuring you find the perfect insurance policy for your vehicle and budget.

Getting quotes insurance car online can be a convenient way to compare rates and coverage options. By providing basic information about your vehicle and driving history, you can receive multiple quotes from different insurance companies. This allows you to make an informed decision about which policy is right for you.

You can get a car insurance estimate online in just a few minutes, so there’s no reason not to shop around for the best deal on quotes insurance car.

Car Insurance Quotes: An Overview

Car insurance quotes provide an estimate of the cost of car insurance coverage. They help you compare policies and find the best coverage for your needs. Quotes are influenced by factors such as age, driving history, and vehicle type.

Types of Car Insurance Quotes

– Liability quotes cover damage to other vehicles and property.

– Collision quotes cover damage to your own vehicle.

– Comprehensive quotes cover damage from events other than collisions, such as theft or vandalism.

How to Get Car Insurance Quotes

Online

– Visit the website of an insurance company or insurance aggregator.

– Enter your information and receive multiple quotes.

Through an Agent

– Contact an insurance agent who can provide quotes from multiple companies.

– Discuss your needs and preferences with the agent.

Over the Phone

– Call an insurance company and provide your information over the phone.

– Receive a quote and discuss coverage options with a representative.

Factors to Consider When Choosing Car Insurance Quotes

Coverage Limits

– Choose coverage limits that meet your financial needs.

– Higher limits provide more protection but increase premiums.

Deductibles

– The deductible is the amount you pay out-of-pocket before insurance coverage kicks in.

– Higher deductibles lower premiums but increase your out-of-pocket costs in the event of a claim.

Discounts

– Ask about discounts for things like good driving history, multiple policies, or anti-theft devices.

– Discounts can significantly reduce your premiums.

Additional Considerations for Car Insurance Quotes

Credit Score

– Some insurance companies use credit scores to determine premiums.

– A higher credit score can lead to lower premiums.

Claims History, Quotes insurance car

– A history of claims can increase your premiums.

– Try to maintain a clean driving record to keep premiums low.

Garaging Location

– Where you park your car can affect your premiums.

– Parking in a garage is typically safer and can lead to lower premiums.

Closing Summary: Quotes Insurance Car

Whether you’re a seasoned driver or a new car owner, this guide has equipped you with the essential knowledge to navigate the quotes insurance car landscape. Remember to carefully consider your individual needs, compare multiple quotes, and consult with an insurance professional if necessary. By following these steps, you can secure the peace of mind that comes with knowing your vehicle is adequately protected.

Getting quotes for car insurance is crucial, but it’s equally important to understand the factors that affect car insurance prices. These factors include your driving history, vehicle type, and location. By considering these elements, you can make informed decisions about your coverage and find the most competitive rates for your quotes insurance car.

Expert Answers

What factors influence car insurance quotes?

Factors that influence car insurance quotes include age, driving history, vehicle type, location, and coverage limits.

How can I get car insurance quotes?

You can obtain car insurance quotes online, through an agent, or over the phone. Comparing quotes from multiple providers is recommended to find the best coverage at the most competitive price.

What should I consider when choosing car insurance quotes?

When choosing car insurance quotes, consider coverage limits, deductibles, discounts, and the terms and conditions of the policy. Understanding the exclusions and limitations is also crucial.