Get a car insurance quote – Navigating the complexities of car insurance can be daunting, but understanding the fundamentals and factors that influence your quote is crucial. From coverage types to comparison shopping, this comprehensive guide will empower you to make informed decisions and secure the best car insurance quote tailored to your unique needs.

Whether you’re a seasoned driver or a first-time policyholder, this guide will provide you with the knowledge and tools you need to get the right coverage at the right price.

Insurance Policy Basics

Car insurance policies provide financial protection against accidents and other covered events. There are different types of coverage available, each offering varying levels of protection:

Comprehensive Coverage

Covers damage to your vehicle from non-collision events, such as theft, vandalism, or natural disasters.

Collision Coverage

Covers damage to your vehicle from collisions with other vehicles or objects.

Liability Coverage, Get a car insurance quote

Covers damages and injuries you cause to others or their property.

Deductibles are amounts you pay out-of-pocket before insurance coverage kicks in. Higher deductibles typically result in lower premiums.

Factors Influencing Quotes

Several factors affect car insurance quotes, including:

Age and Driving History

Younger drivers and those with accidents or traffic violations tend to pay higher premiums.

Location

Premiums vary based on factors such as population density, crime rates, and weather conditions.

Credit Score

Insurers may use credit scores to assess risk and set premiums. Higher credit scores often lead to lower premiums.

Vehicle Type

Premiums can vary depending on the make, model, and safety features of your vehicle.

Discounts and Promotions

Many insurers offer discounts for things like safe driving, multiple policies, and good student grades.

Comparison Shopping

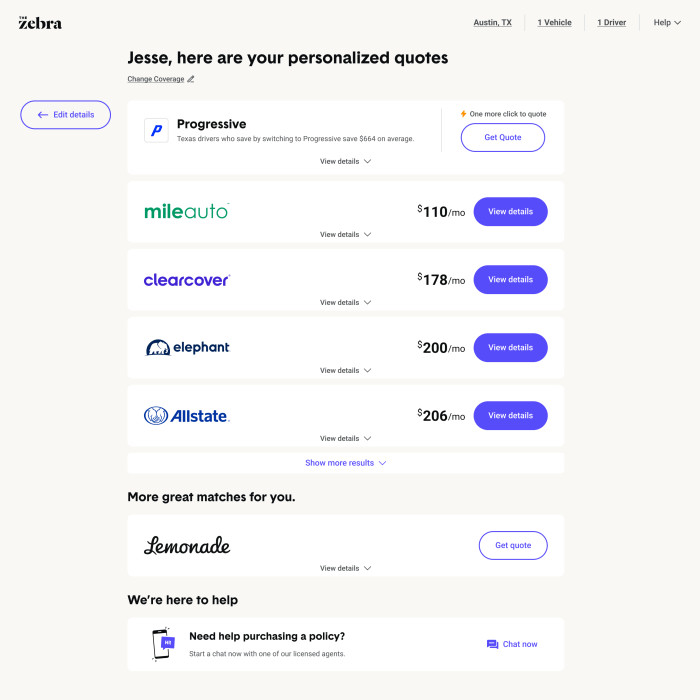

Comparing quotes from multiple insurers is crucial for finding the best deal.

Online Comparison Tools

These tools allow you to quickly compare quotes from several insurers.

Advantages of Comparison Shopping

– Identify the best coverage and rates.

– Save time and effort.

– Avoid overpaying for insurance.

Understanding Coverage Limits

Coverage limits determine the maximum amount your insurance will pay for claims.

Impact on Claims Payouts

Coverage limits can affect how much you receive for repairs or injuries.

Determining Appropriate Coverage Limits

Consider your vehicle’s value, potential risks, and financial situation when determining coverage limits.

Special Considerations: Get A Car Insurance Quote

High-Risk Drivers

Drivers with poor driving records or other high-risk factors may need to pay higher premiums or purchase specialized insurance.

Drivers with Poor Credit or Accident History

Insurers may offer coverage options tailored to drivers with these challenges.

Specialty Vehicles

Classic cars and motorcycles may require specialized insurance policies to cover their unique needs.

Closure

Securing the right car insurance quote is essential for protecting your financial well-being and ensuring peace of mind on the road. By understanding the basics, comparing quotes, and considering your individual circumstances, you can make an informed decision that meets your needs and budget. Remember, the best car insurance quote is the one that provides comprehensive coverage without breaking the bank.

Obtaining a car insurance quote is a crucial step in securing financial protection for your vehicle. If you reside in New York City, exploring car insurance quotes nyc is essential to find the most competitive rates. By comparing quotes from multiple insurers, you can ensure that you get the best coverage at an affordable price.

FAQ Guide

What factors influence car insurance quotes?

Age, driving history, location, credit score, vehicle type, and discounts all play a role in determining your car insurance premium.

How can I compare car insurance quotes?

To get a car insurance quote that meets your specific needs, it’s recommended to connect with a reputable car insurance agency near me. These agencies have expert advisors who can guide you through the process, compare quotes from multiple providers, and ensure you get the best coverage at the most competitive rates.

Ultimately, getting a car insurance quote is essential for protecting your vehicle and yourself financially, and working with a local agency can provide invaluable assistance in making an informed decision.

Online comparison tools and contacting multiple insurance companies directly are effective ways to compare quotes and find the best deals.

What are coverage limits and why are they important?

Before finalizing your car insurance quote, it’s crucial to understand the intricacies of a car insurance policy. A comprehensive policy outlines the coverage, exclusions, and terms that will protect you in the event of an accident. By thoroughly reviewing the policy, you can make an informed decision and ensure that your vehicle and financial well-being are adequately safeguarded.

Armed with this knowledge, you can confidently complete your car insurance quote, knowing that you have chosen the best coverage for your needs.

Coverage limits determine the maximum amount your insurance policy will pay for covered expenses. Understanding and setting appropriate limits is crucial to ensure adequate protection.

What special considerations should high-risk drivers make?

High-risk drivers may face higher premiums but can explore options such as non-standard insurance, usage-based insurance, and defensive driving courses to mitigate costs.