The cheapest cars to insure offer a cost-effective solution for drivers seeking financial relief. By understanding the factors that influence insurance premiums, you can make informed decisions and find the perfect vehicle that fits your budget and safety needs.

From analyzing car characteristics to comparing insurance providers, this comprehensive guide will empower you with the knowledge to secure the most affordable insurance coverage for your vehicle.

Insurance Costs and Factors

Insurance premiums for vehicles are influenced by various factors, including:

- Make and model of the car

- Age of the car

- Driving history of the insured

- Location where the car is driven

- Type of coverage desired

Identifying Low-Cost Cars to Insure: Cheapest Cars To Insure

Cars that are typically less expensive to insure include:

- Smaller, less powerful cars

- Cars with good safety ratings

- Cars with anti-theft devices

- Cars driven by experienced drivers

| Car Model | Insurance Cost |

|---|---|

| Honda Civic | $1,200 per year |

| Toyota Corolla | $1,300 per year |

| Hyundai Elantra | $1,400 per year |

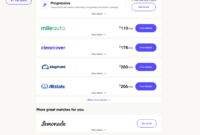

Comparison of Insurance Providers

Different insurance providers offer different coverage options and premiums. It is important to compare quotes from multiple providers before purchasing insurance.

The cheapest cars to insure often have a lower value, fewer features, and are less likely to be stolen. If you’re looking for a more comprehensive insurance policy that covers both your car and your home, consider getting car and house insurance quotes.

This type of policy can provide you with peace of mind knowing that you’re protected in the event of an accident or other covered event.

- Geico

- Progressive

- State Farm

- Allstate

- Farmers

| Insurance Provider | Premium for Honda Civic |

|---|---|

| Geico | $1,200 per year |

| Progressive | $1,300 per year |

| State Farm | $1,400 per year |

Discounts and Savings

There are various discounts and savings available to reduce insurance premiums, including:

- Multi-car discounts

- Good driver discounts

- Anti-theft discounts

- Safety feature discounts

- Low mileage discounts

Example: Geico offers a 25% discount for drivers who have been accident-free for five years.

Safety Features and Insurance Costs

Advanced safety features can lower insurance costs by reducing the risk of accidents.

- Anti-lock brakes

- Traction control

- Airbags

- Lane departure warning systems

- Automatic emergency braking

Example: A car with automatic emergency braking may be eligible for a 10% discount on insurance premiums.

Additional Considerations

Other factors to consider when evaluating insurance costs for vehicles include:

- Mileage driven per year

- Purpose of the vehicle (e.g., commuting, pleasure driving)

- Credit score

- Insurance deductibles

- State insurance regulations

Tip: Negotiating with insurance companies can sometimes result in lower premiums. Be prepared to provide documentation to support your request for a lower rate.

Closing Summary

Remember, choosing the cheapest cars to insure is a multifaceted process that requires careful consideration of various factors. By following the insights Artikeld in this guide, you can navigate the insurance landscape with confidence and find the most cost-effective solution that meets your specific needs.

FAQ Resource

What factors influence insurance premiums for vehicles?

Insurance premiums are determined by several factors, including the make and model of the car, your driving history, age, location, and coverage level.

Finding the cheapest cars to insure can save you a significant amount of money on your car insurance policy. In New Jersey, car insurance rates can vary depending on a number of factors, including the type of car you drive.

By choosing a car that is known to be inexpensive to insure, you can help to keep your car insurance costs low.

How can I find the cheapest cars to insure?

Look for vehicles with low safety ratings, low repair costs, and a good theft record. Consider older models and cars with smaller engines.

What discounts can I get on car insurance?

The most affordable vehicles to insure are frequently older models, economy cars, and those with excellent safety ratings. If you’re looking for additional information or want to speak with an insurance agent, you can reach Progressive Car Insurance at this phone number.

They can provide personalized quotes and assist you in selecting the best coverage for your budget. Additionally, by researching and comparing quotes from different insurance providers, you can further ensure that you’re getting the most affordable coverage for your cheapest car to insure.

Many insurance companies offer discounts for things like being a safe driver, having a good credit score, and bundling your home and auto insurance.