Cheapest car insurance florida is a critical aspect for drivers seeking to protect themselves financially while complying with state laws. Understanding the factors influencing premiums, comparing rates, and exploring affordable options can help you secure the best coverage at the most reasonable cost. Dive into this comprehensive guide to discover everything you need to know about finding cheap car insurance in Florida.

1. Factors Influencing Car Insurance Premiums in Florida

Car insurance premiums in Florida are determined by a variety of factors, including age, driving history, location, and the type of coverage you choose.

Age

Younger drivers typically pay higher premiums than older drivers because they are considered to be a higher risk.

Driving History

Drivers with a clean driving record will typically pay lower premiums than drivers with a history of accidents or traffic violations.

Location, Cheapest car insurance florida

The cost of car insurance can vary significantly depending on where you live. Drivers in urban areas typically pay higher premiums than drivers in rural areas.

Coverage Type

The type of coverage you choose will also affect the cost of your premium. Liability coverage is the minimum required coverage in Florida, but you may also want to consider collision and comprehensive coverage.

2. Average Car Insurance Rates in Florida: Cheapest Car Insurance Florida

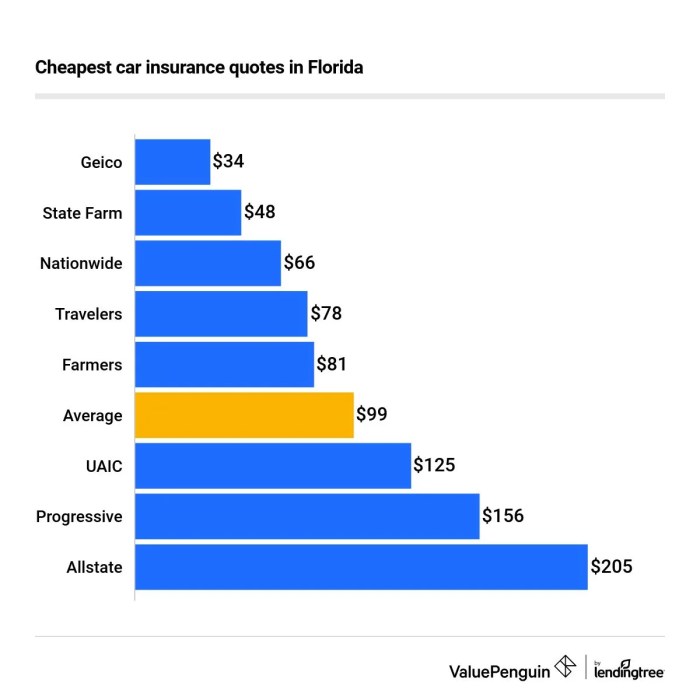

The average cost of car insurance in Florida is $1,674 per year. However, rates can vary significantly depending on the factors discussed above.

Finding the cheapest car insurance in Florida can be a daunting task, but with a few simple steps, you can save yourself a lot of money. One of the best ways to compare rates is to get car insurance quotes from multiple companies.

This will allow you to see which companies offer the lowest rates for your specific needs. Once you have a few quotes, you can then compare them and choose the company that offers the best coverage at the lowest price.

City Comparison

- Miami: $2,212

- Orlando: $1,748

- Tampa: $1,632

- Jacksonville: $1,596

- Fort Lauderdale: $2,048

National Comparison

Florida’s average car insurance rates are higher than the national average of $1,548 per year.

3. Tips for Finding Affordable Car Insurance in Florida

There are a number of things you can do to find affordable car insurance in Florida.

Florida has some of the cheapest car insurance rates in the country, but drivers in New Jersey may be surprised to learn that their rates are even lower.

Car insurance in New Jersey is typically 10-20% cheaper than in Florida, thanks to a combination of factors including lower crime rates and a more efficient insurance market.

However, it’s important to shop around and compare quotes from multiple insurers to find the best rate for your individual needs, whether you’re in Florida or New Jersey.

Compare Quotes

The best way to find the best rate is to compare quotes from multiple insurance companies.

Negotiate

Once you have a few quotes, don’t be afraid to negotiate with the insurance companies to get a lower rate.

Discounts

Many insurance companies offer discounts for things like being a good driver, having a clean driving record, and taking a defensive driving course.

4. Top-Rated Car Insurance Companies in Florida

| Company | Coverage Options | Customer Service | Financial Stability |

|---|---|---|---|

| State Farm | Comprehensive coverage options | Excellent customer service ratings | Strong financial stability |

| Geico | Wide range of coverage options | Good customer service ratings | Very strong financial stability |

| Progressive | Affordable rates | Good customer service ratings | Strong financial stability |

| Allstate | Nationwide coverage | Excellent customer service ratings | Strong financial stability |

| USAA | Military-exclusive coverage | Exceptional customer service ratings | Very strong financial stability |

5. Special Considerations for High-Risk Drivers in Florida

High-risk drivers may face challenges in obtaining affordable car insurance.

In the Sunshine State, drivers seeking the most affordable car insurance coverage can benefit from comparing quotes from multiple providers. To obtain a personalized estimate, consider visiting a reputable platform that offers instant quotes like get car insurance quote.

This service provides a comprehensive comparison of policies and rates, empowering you to make an informed decision and secure the cheapest car insurance in Florida.

Types of Coverage

High-risk drivers may need to purchase specialized coverage, such as non-owner insurance or SR-22 insurance.

Finding Affordable Options

High-risk drivers can find affordable insurance options by comparing quotes from multiple insurance companies and taking advantage of discounts.

Summary

In the competitive insurance landscape of Florida, finding the cheapest car insurance florida requires careful research and consideration of your individual circumstances.

By following the tips Artikeld in this guide, you can navigate the insurance market effectively, compare quotes, and make informed decisions to secure affordable coverage that meets your needs.

Remember, taking the time to explore your options can lead to significant savings, ensuring you have the protection you need without breaking the bank.

Detailed FAQs

What factors influence car insurance premiums in Florida?

Factors such as age, driving history, location, coverage level, and credit score can impact insurance rates.

How can I find affordable car insurance in Florida?

Compare quotes from multiple insurance companies, negotiate lower rates, and take advantage of discounts and loyalty programs.

What are the top-rated car insurance companies in Florida?

Top-rated companies include Geico, State Farm, Progressive, USAA, and Allstate.