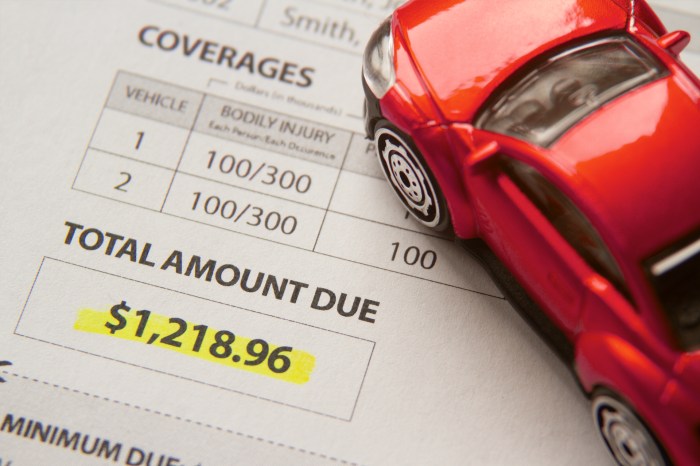

In the realm of personal finance, low cost car insurance near me stands as a beacon of hope, offering drivers a lifeline to affordable protection. This comprehensive guide delves into the intricacies of finding the perfect insurance policy that safeguards your vehicle without breaking the bank.

If you’re searching for low cost car insurance near me, it’s wise to compare quotes from multiple providers. Utilize free car insurance quotes here to swiftly and easily compare prices from leading insurers.

This enables you to make an informed decision and secure the most competitive rate on low cost car insurance near me.

Navigating the complexities of car insurance can be daunting, but with the right knowledge and resources, you can secure peace of mind without sacrificing your financial well-being.

If you’re looking for low cost car insurance near me, you may want to consider getting online car insurance quotes. Online car insurance quotes can help you compare rates from different insurance companies, so you can find the best deal on low cost car insurance near me.

Low-Cost Car Insurance Near Me

Finding affordable car insurance can be a challenge, especially if you’re on a budget. However, there are a number of ways to save money on your car insurance premiums, including:

Insurance Providers

The first step is to shop around and compare quotes from different insurance providers. Here is a table of some local insurance providers that offer low-cost car insurance:

| Company Name | Contact Information | Description |

|---|---|---|

| Geico | (800) 207-7326 | Geico offers a variety of discounts for low-cost car insurance, including discounts for bundling policies, maintaining a good driving record, and taking defensive driving courses. |

| Progressive | (800) 841-3300 | Progressive offers a “Name Your Price” tool that allows you to set your own budget for car insurance. |

| State Farm | (800) 462-7676 | State Farm offers a variety of discounts for low-cost car insurance, including discounts for bundling policies, maintaining a good driving record, and being a safe driver. |

Coverage Options

Another way to save money on car insurance is to choose the right coverage options. Here are some of the different coverage options available for low-cost car insurance:

- Liability coverage: This is the minimum amount of coverage required by law. It covers you if you are at fault for an accident and cause damage to someone else’s property or injuries.

- Collision coverage: This covers you if you are in an accident with another vehicle or object.

- Comprehensive coverage: This covers you for damages to your car that are not caused by a collision, such as theft, vandalism, or fire.

The type of coverage you choose will depend on your individual needs and budget.

Factors Affecting Cost

The cost of car insurance can be affected by a number of factors, including:

- Driving history: Drivers with a clean driving record will typically pay less for car insurance than drivers with a history of accidents or traffic violations.

- Age: Young drivers are typically more expensive to insure than older drivers.

- Location: The cost of car insurance can vary depending on where you live. Drivers in urban areas typically pay more for car insurance than drivers in rural areas.

- Type of vehicle: The cost of car insurance can also vary depending on the type of vehicle you drive. Sports cars and luxury cars are typically more expensive to insure than sedans and minivans.

There are a number of things you can do to reduce your car insurance premiums, such as:

- Maintaining a good driving record

- Taking defensive driving courses

- Bundling your car insurance with other policies, such as home insurance or renters insurance

- Increasing your deductible

Discounts and Savings

There are a number of discounts and savings available for low-cost car insurance. Here are some of the most common:

- Bundling discounts: You can save money on your car insurance by bundling it with other policies, such as home insurance or renters insurance.

- Good driver discounts: Drivers with a clean driving record can qualify for discounts on their car insurance.

- Defensive driving course discounts: Drivers who complete a defensive driving course can qualify for discounts on their car insurance.

- Low mileage discounts: Drivers who drive less than a certain number of miles per year can qualify for discounts on their car insurance.

To qualify for these discounts, you will need to contact your insurance provider and ask if they offer them.

Comparison Tools

There are a number of online comparison tools that can help you compare quotes from multiple insurance providers. Here are some of the most popular comparison tools:

- NerdWallet

- The Zebra

- Insurance.com

These comparison tools can help you find the best deal on car insurance by comparing quotes from multiple insurance providers.

Local Resources

There are a number of local resources that can assist you with finding low-cost car insurance. Here are some of the most helpful resources:

- Community organizations: There are a number of community organizations that can help you find low-cost car insurance. These organizations typically offer free or low-cost services to help you find the best deal on car insurance.

- Government agencies: There are a number of government agencies that can help you find low-cost car insurance. These agencies typically offer free or low-cost services to help you find the best deal on car insurance.

These local resources can help you find the best deal on car insurance by providing you with information and assistance.

In today’s economy, it’s essential to find affordable car insurance that meets your needs. For those looking for low cost car insurance near me, getting a quote online is a great way to compare rates and find the best coverage.

Visit get car insurance quote to get started and secure peace of mind with low cost car insurance near me.

Wrap-Up

Remember, finding low cost car insurance near me is not just about saving money; it’s about ensuring your financial security and protecting your most valuable assets.

By following the tips and strategies Artikeld in this guide, you can drive with confidence, knowing that you have the right coverage at the right price.

Question Bank: Low Cost Car Insurance Near Me

What factors affect the cost of car insurance?

The cost of car insurance is influenced by various factors, including driving history, age, location, type of vehicle, and coverage options.

How can I reduce my car insurance premiums?

There are several ways to reduce your car insurance premiums, such as maintaining a good driving record, bundling policies, taking defensive driving courses, and increasing your deductible.

What are the different types of car insurance coverage?

Common types of car insurance coverage include liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection.